Two, accelerate revenue growth from financial services, including both Lightspeed Payments and Lightspeed Capital. We expect this to show up as an increased platform adoption among high GTV merchants, higher ARPU and more efficient and rapid product innovation. As we look to better align ourselves to the rule of 40 metrics, this fiscal year Lightspeed expects to, one, reap the benefits of having our One Lightspeed flagship product in market. I would say that we have spent the last four years establishing the foundations of this formidable company.Īnd now, fiscal 2024 will be our year of execution. And earlier this year, it meant reorganizing how we operate to become a more nimble and streamlined company. It meant honing on our sales and marketing organization to better target higher GTV customers. It meant making key strategic acquisitions. Since we went public on the Toronto Stock Exchange in 2019, we have been laser focused on becoming the go-to platform for sophisticated retailers and restauranteurs around the world.ĭelivering on the strategy meant building our payments platform from ground up. Our GPV volumes were up by 70% year-over-year and our adjusted EBITDA loss of $4.3 million came in significantly better than expected.Īs we enter fiscal 2024, let me walk you through how we see this year unfolding.

We achieved an organic revenue growth rate of 26%. Overall, I was very happy with our results this quarter. With that, I will now turn the call over to JP. Reconciliations between the two can be found in our earnings press release, which is available on our website, on and on the SEC's EDGAR system.Īnd finally note that because we report in US dollars, all amounts discussed today are in US dollars unless otherwise indicated. These should be considered as a supplement to, and not a substitute for, IFRS financial measures. You should carefully review these factors, assumptions, risks, and uncertainties in our earnings press release issued earlier today, our fourth quarter 2023 results presentation available on our website, as well as in our filings with US and Canadian securities regulators.Īlso, our commentary today will include adjusted financial measures, which are non-IFRS measures and ratios.

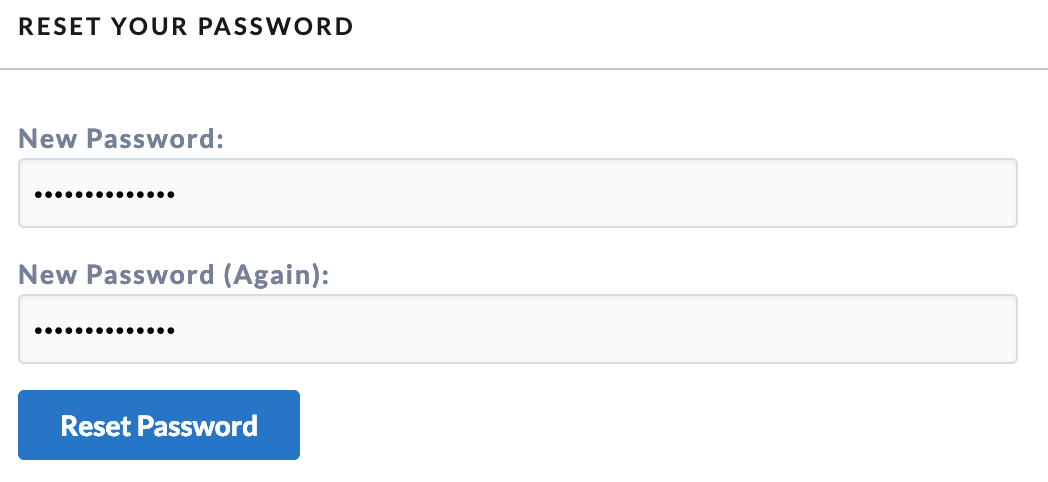

#LIGHTSPEED ONSITE DEMO UPDATE#

We undertake no obligation to update these statements, except as required by law.

Certain material factors and assumptions were applied in respect of conclusions, forecasts and projections contained in these statements. We will make forward-looking statements on our call today that are subject to risks and uncertainties that could cause actual results to differ materially from those projected. After prepared remarks, we will open it up for your questions. Joining me today are JP Chauvet, Lightspeed's Chief Executive Officer, and Asha Bakshani, our Chief Financial Officer. Welcome to Lightspeed's fiscal Q4 2023 conference call. I would now like to turn the call over to Gus Papageorgiou.

After the speakers' remarks, there will be a Q&A session. All lines have been placed on mute to prevent any background noise.

Hello, and welcome to the Lightspeed Fourth Quarter 2023 Earnings Call. Thanos Moschopoulos - BMO Capital Markets Jean Paul Chauvet - Chief Executive Officer Gus Papageorgiou - Head of Investor Relations ( NYSE: LSPD) Q4 2023 Results Earnings Conference Call 8:00 AM ET

0 kommentar(er)

0 kommentar(er)